Award-winning PDF software

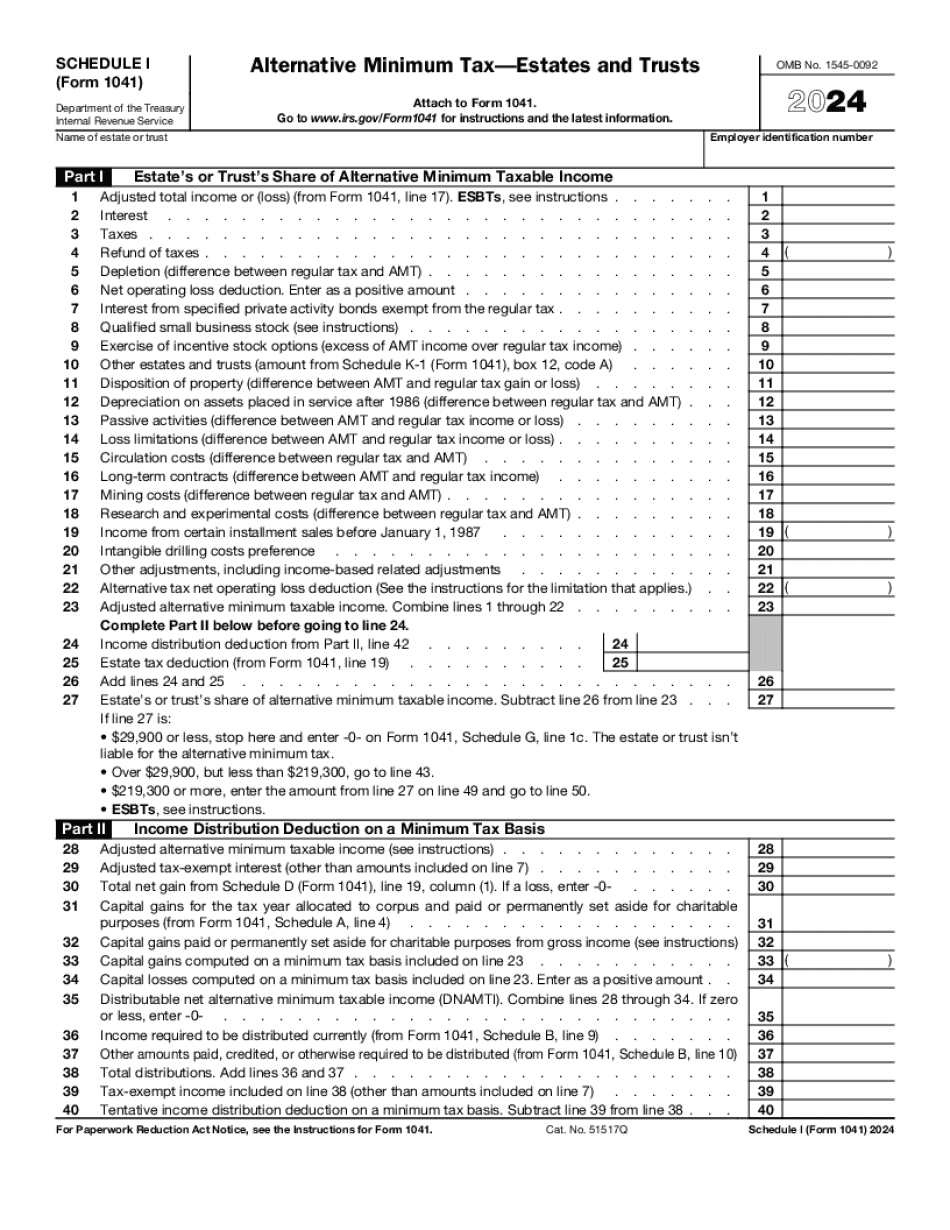

Massachusetts Form 1041 (Schedule I): What You Should Know

See IR-2018-38 at Form 1099. Forms 1099-K and 1099-MISC are used by law enforcement as an information source for the Internal Revenue Service. All individuals must have to report their gross and net income. Forms 1096 (1099-K) and 1098-EZ are used by the federal government for reporting financial transactions for certain health insurance (including long term care), 401(k) retirement plans, and other employee benefit plans. Form 8829. The information is only used under limited circumstances to conduct civil or criminal investigations. Form 8904 (Non-Individual Estate Tax Return). Form 8904-A, Non-Individual Estate Tax Return (PDF) is used by non-probate claimants who wish to prove that they are not subject to the estate tax but do not wish to file a separate Form 8904, such as people who need to prove certain financial records. Form 2555 (Fiduciary) and Form 2555-EZ (Fiduciary) and Schedule K (Form 1040), Estate or Trust Income Tax Return (Form 1040) for Fiduciaries and Partners. The non-resident FIDUCIARY and PRIVATE PARTNER of a partnership or trust must pay Massachusetts income tax in accordance with U.S. Federal law Form 2748 (Fiduciary and Partnership) and Form 5744 for Partners and Fiduciaries. The non-resident FIDUCIARY and PRIVATE PARTNER of a partnership or trust must pay Massachusetts income tax in accordance with U.S. Federal law U.S. Form 1041 (Proper Schedule) and Forms 1099 (Form 1042). U.S. Trusts and Estate Tax return for certain trusts, estates, and estates. The U.S. Form 1041, and all its attachments, are used for any transfer of real estate or other personal property, whether at fair market value. Form 1065 (1040). The Form 1065 form must be used along with FAFSA (Free Application for Federal Student Aid).

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Massachusetts Form 1041 (Schedule I), keep away from glitches and furnish it inside a timely method:

How to complete a Massachusetts Form 1041 (Schedule I)?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Massachusetts Form 1041 (Schedule I) aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Massachusetts Form 1041 (Schedule I) from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.