Award-winning PDF software

Form 1041 (Schedule I) AR: What You Should Know

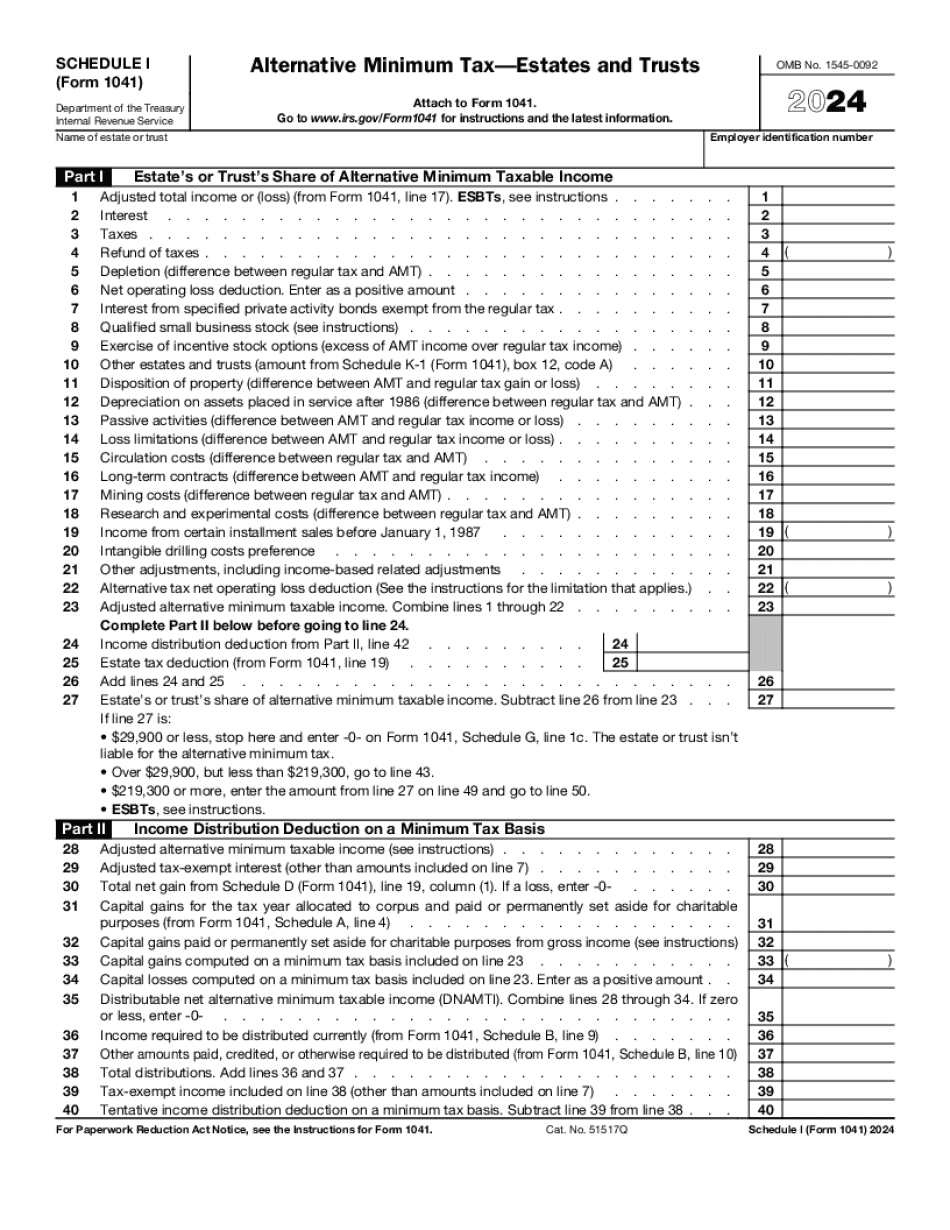

If you have received a Schedule K-1, you have to file an amended or correct Schedule K-1 in order to be eligible for an amortization extension under section 72(p). If your income is substantially equivalent, and you did not receive an amortization extension, you can avoid this requirement by filing a Form 7035 and withholding 10 percent of your adjusted gross income from your gross income for the current tax year, instead of the current tax year and the prior 3 tax years. For more information about decedents estates and trusts, read the section below. Fiduciary Income Tax Form 706 — Qualified Fiduciary Income. If You Are an Attorney, Surgeon, or Therapist. If you are an attorney or physician and a beneficiary (not including the decedent's estate) who receives income from a specific practice as an attorney, practitioner of medicine, or psychologist, or as an employee of a hospital and a practitioner of medicine, a doctor of dentistry, osteopathic physician, osteopath, surgeon, or therapist (with respect to such income), or an officer, director, or manager of a foundation or charity where the income is from specific practice activities, you can use Form 706, Qualified Fiduciary Income, to figure which of your qualified income is subject to the Medicare tax on the amount of income, or you can use Form 710, Self-Employed IRA Plan Income, to figure the amount that is subject to the 10 percent early withdrawal penalty. If you are an attorney, practitioner of medicine, or psychologist, who is a beneficiary or other person who receives income from a practice only for the purposes of practicing or practicing medicine (unless the practice is not an entity that is organized or conducted for profit and has a bona fide plan to make at least 90 percent of its gross income from a single source of service), you can complete Form 706, Qualified Fiduciary Income. This form also can be used by a practitioner with respect to qualified doctor or dentist benefits. If you are a beneficiary, however, who receives an income from a practice only for the purposes of practicing or practicing medicine for the benefit of a qualifying patient, you cannot use Form 706. It is important for you to keep an eye on the tax status of your IRA contributions and distributions.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 1041 (Schedule I) AR, keep away from glitches and furnish it inside a timely method:

How to complete a Form 1041 (Schedule I) AR?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 1041 (Schedule I) AR aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 1041 (Schedule I) AR from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.