Award-winning PDF software

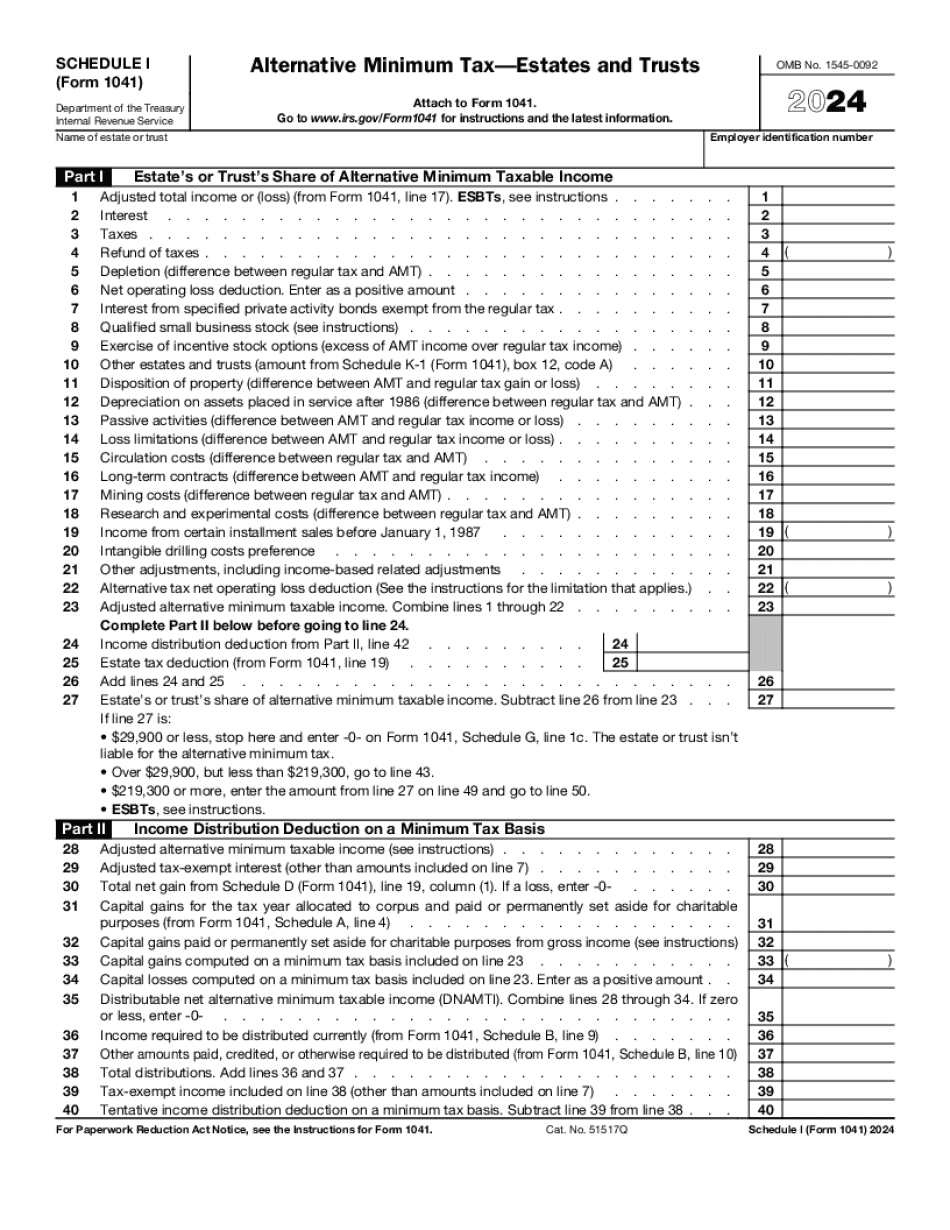

Printable Form 1041 (Schedule I) Clark Nevada: What You Should Know

If the return has a distribution of assets made during the year, you may have problems if you want to apply for an extension to file your return. A final distribution is one where income is subject to the Alternative Minimum Tax and must be taken off the return as long as the amount is over a certain threshold. Also, the property must be sold and either a deduction or net capital gain made. The following may be considered final: a final sale of your residence, a final disposition of a business, a net capital gain on a sale of inventory and a sale of an inventory item used as inventory. For example: you sell a residence, and you receive an offer from a business. The business buys the home, puts the property up for sale and your taxable income is subject to the AMT because you didn't pay certain expenses to a different person in addition to the AMT. You can use the following calculator for a return where a home is sold, where the home is subject to the AMT: A final disposition of a business is one where no property is disposed and the income doesn't qualify for the AMT. Income that is used for any business purpose (rent, royalties) is also not subject to the AMT. Example of a home sale: The home is sold for 200,000, you receive 100,000 in proceeds for the home. The property is depreciated over the life of the home. If you have no additional interest and income in the home until you sell it, you can complete Form 1120S. This document is a general summary of the IRS Form 1041 instructions and instructions for Schedule I. For Taxpayers Reporting a Wages and Profit Contributions Taxable Wages and Profit Contributions Made or Claimed by Employee or Independent Contractor. Wages and Profit Contributions Made or Claimed by Employee or Independent Contractor ▷ Go to ▷ Click on Schedule I (Form 1041) ▷ Click on Payment by Electronic Fund Transfer. NOTE: This form is electronically submitted, but taxpayers are actually making a paper submission. For ease of completion, we recommend that you include a copy of the return, along with Form W-2 for each member of the household. Payments of wages by electronic funds transfer is a payment that is made to a third party, such as a payee, by means of a computer.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Printable Form 1041 (Schedule I) Clark Nevada, keep away from glitches and furnish it inside a timely method:

How to complete a Printable Form 1041 (Schedule I) Clark Nevada?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Printable Form 1041 (Schedule I) Clark Nevada aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Printable Form 1041 (Schedule I) Clark Nevada from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.