Award-winning PDF software

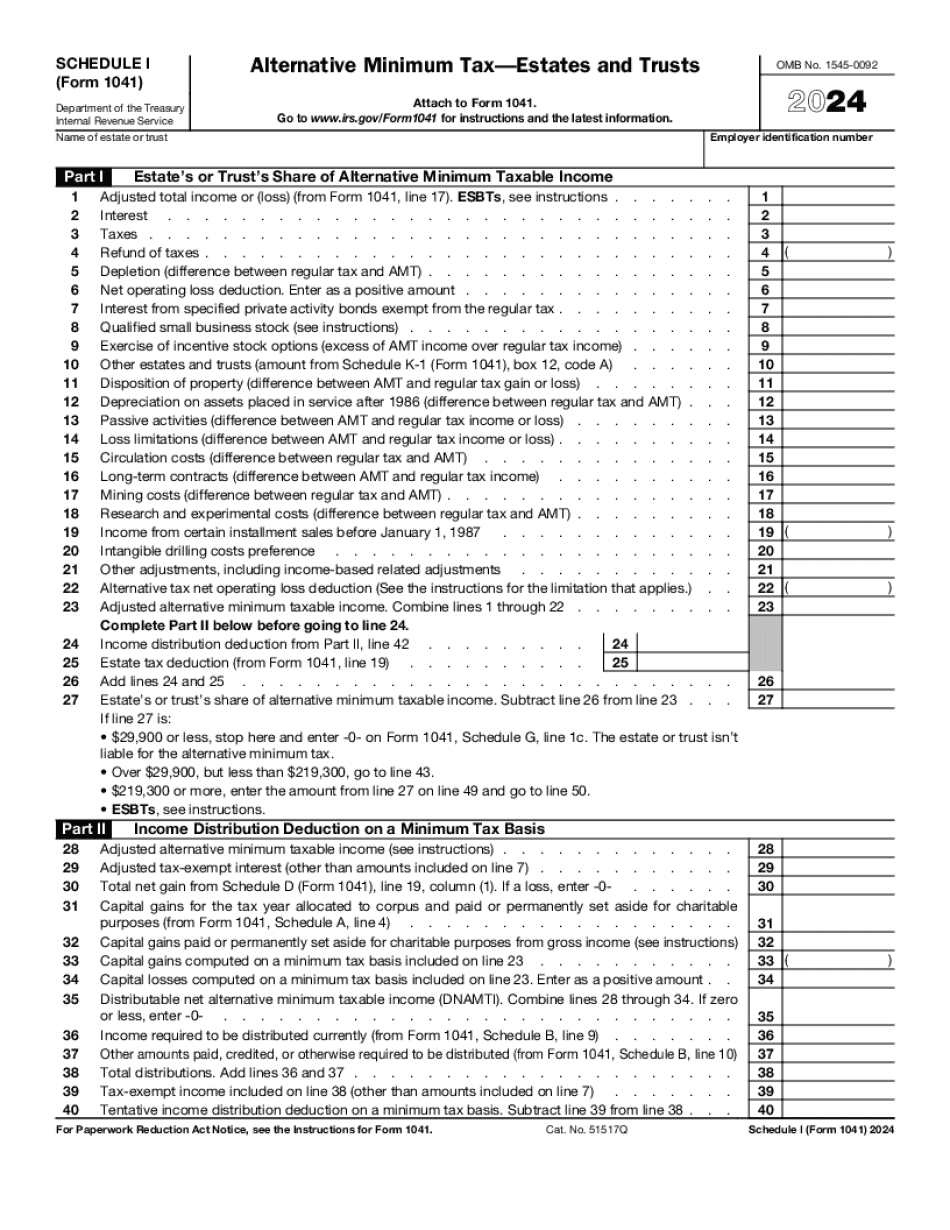

Seattle Washington online Form 1041 (Schedule I): What You Should Know

In this case, “total income” means the sum of the gross income of the trust divided by the gross income of every individual beneficiary.” See the IRS Tax Guide for more information on reporting and paying the estate tax. A portion of your gross estate is taxed at a maximum of 40%. Other taxes payable from a gross estate include the following: Capital gains — capital gains tax is a tax that is paid only if you dispose of an asset that had been held for more than a year tax year. Capital gains tax is payable on unrealized gains (or losses) attributable to an acquisition of a capital asset for your own use or for the use of any other person. However, if you sell your capital asset to a third party who subsequently sells the asset to you the gain (or loss) is not subject to capital gains tax. The capital gains tax is usually due each year on the date you sell your capital asset, unless the sale is a taxable disposition from which capital gains taxes are not due. The capital gain (or loss) is added to gross estate income, and then the remaining amounts are reported on a separate tax return and included in the net estate value. Capital gains tax (also called gift or estate tax) is paid by the original owner of the property. You are not liable for income tax at the time you receive the cash or property under the terms of the gift or estate. You do not have to repay the amounts received because you are not required to pay capital gains tax. This amount is called the “gift tax exclusion.” When your gift tax exclusion is exhausted, you may be required to pay tax, even if there's no gift tax. For example, someone may sell their business when they sell their home. When it's time to pay taxes on the gain, they will have to pay capital gains tax. The gift tax exclusion amount (also called the “gift tax exemption”) will expire if you haven't used it for one year or more. To prevent the death tax from applying when you have not used your exemption, you must include in the gross estate amount of your estate an amount equal to your exemption amount. For 2017, the total exemption amount is 5.2 million. In this case, the person you inherit would be responsible for paying tax on any cash received. See the instructions to IRS Form 706. Income Tax Rates A tax rate (also called tax rate) of any particular rate refers to the rate of any specific tax.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Seattle Washington online Form 1041 (Schedule I), keep away from glitches and furnish it inside a timely method:

How to complete a Seattle Washington online Form 1041 (Schedule I)?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Seattle Washington online Form 1041 (Schedule I) aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Seattle Washington online Form 1041 (Schedule I) from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.