Award-winning PDF software

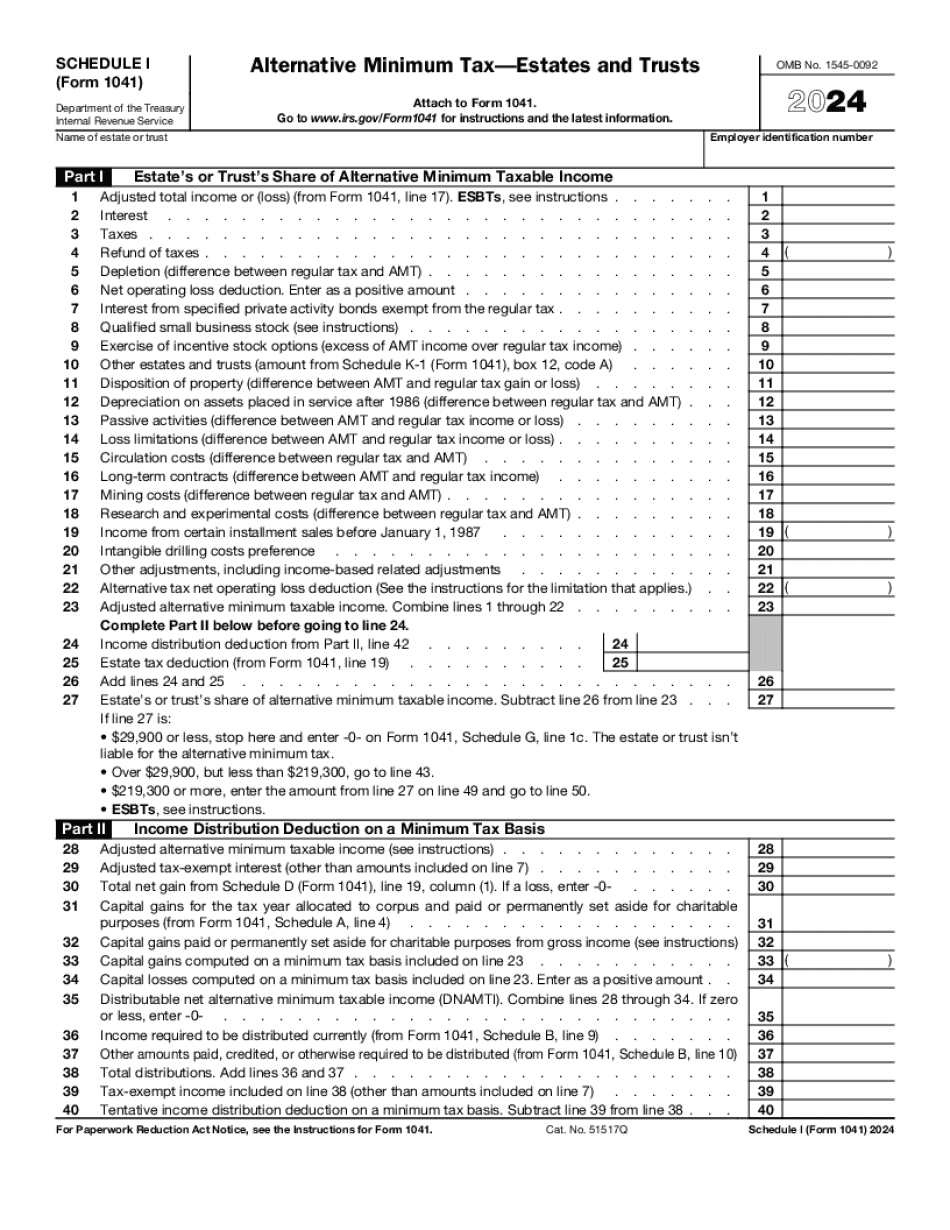

Printable Form 1041 (Schedule I) High Point North Carolina: What You Should Know

Form G-1041 Request for a U.S. Citizenship and Immigration Services (USCIS) Historical Database Search Aug 20, 2025 — File Form 66 as soon as possible and return it to the Idaho State Tax Commission with the information requested on Form 2826. Aug 28, 2025 — If the Form 2826 includes information for the entire entity, file another copy or complete the form. Filing and Payment of Idaho Property Taxes — Idaho State Tax Commission Direct deposit. Form 5400-DE, or 5490-DE, may be necessary to file or pay property taxes. Filing and payment. Payment may be made by cashier's check, money order, or credit/debit card. Payment received in U.S. banks will be processed and paid directly to the Idaho State Tax Commission. Payment cannot be made by mail. Payments of interest may be made by check payable to “The State of Idaho.” Payments of delinquent tax refunds made to a credit or debit card must be made prior to the scheduled tax due date. If credit has been obtained, payment is due within 60 days after the credit is received and may be made by cash or check. If debit has been obtained, the tax refund will be debited from your account at least 20 days prior to the scheduled tax due date. No payment of Idaho income tax may be made without a valid ID or other appropriate government issued form of identification. A copy of a valid government-issued identification such as a Social Security card, driver's license, or military ID may be accepted as proof of your Idaho ID card. Late filings of tax returns and returns with incorrect or incomplete amounts are subject to penalties and interest. The person who prepared the return is responsible for correcting the mistakes, which may include the correcting the required personal information, adding a line below the personal section on Schedule L, or even correcting the information in the signature line of Form 1040, Schedule A, in Section 2B (b) of the instructions. If the person is unable to correct this information or make appropriate clerical corrections on such return, the penalty will be added to the original charge for the return or the late filing will be charged and added to the final assessment. For more information, visit Idaho State Tax Commission website, or call at least 7 days prior to the due date.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Printable Form 1041 (Schedule I) High Point North Carolina, keep away from glitches and furnish it inside a timely method:

How to complete a Printable Form 1041 (Schedule I) High Point North Carolina?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Printable Form 1041 (Schedule I) High Point North Carolina aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Printable Form 1041 (Schedule I) High Point North Carolina from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.