Award-winning PDF software

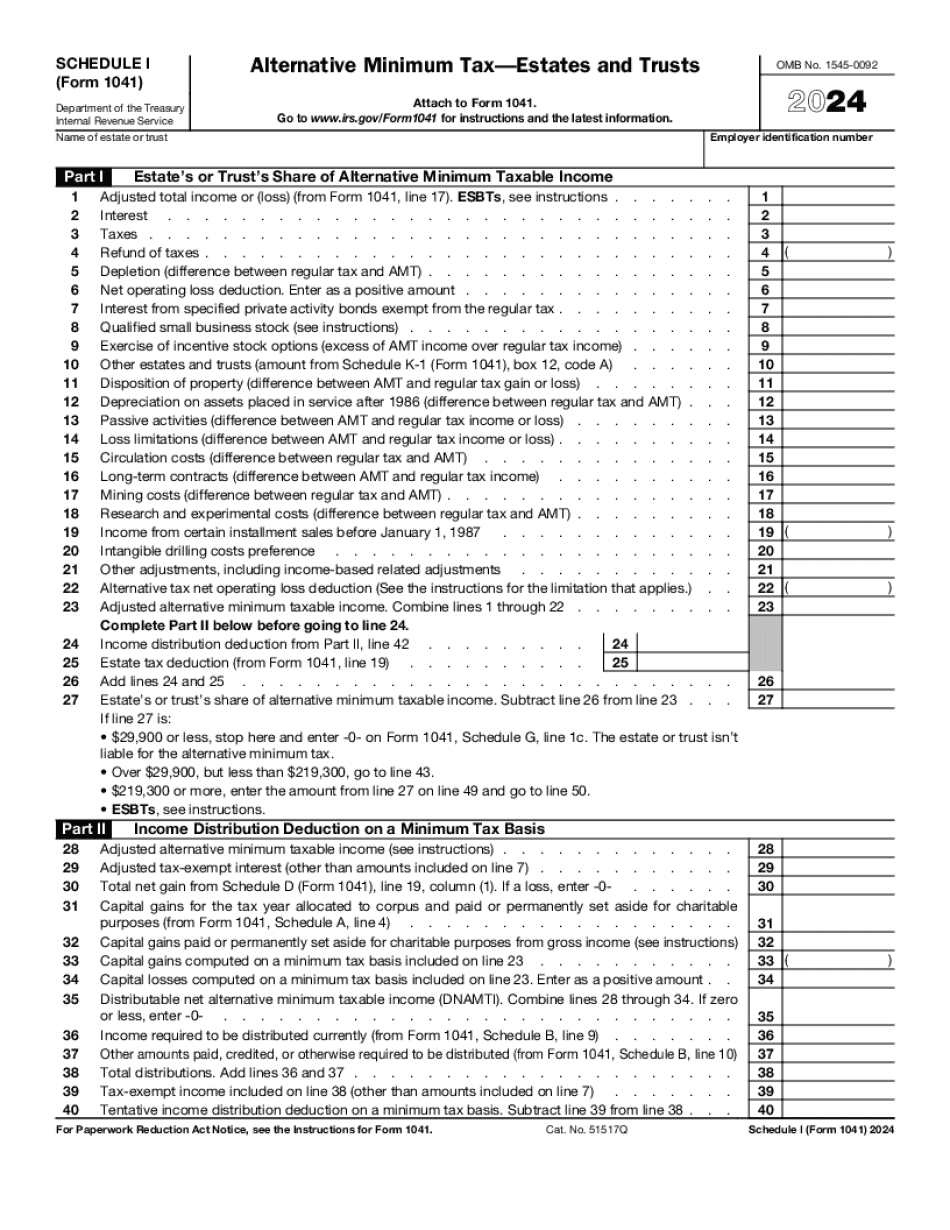

Form 1041 (Schedule I) online Knoxville Tennessee: What You Should Know

Join the mailing list now! A Note on the Church, Creditors, and Clergy The Catholic Church has an extensive trust system of financial management. Trusts are not limited in number but are generally kept in a single account. For example, a Catholic who is paying off a college loan pays no income tax; when the loan is paid off the trust funds are released and the Catholic receives the income tax deduction. When a Catholic receives an allowance from her priest, that allowance is considered a trust fund and the priest's salary is taxed in the amount of the allowances he grants. (Even if a priest does not receive an allowance that he has received for another reason.) In general, Catholic priests are exempt from income tax if they are exempt from Social Security, Medicare, unemployment, or any federal or state income tax. This exemption is called the Social Security and Medicare Preference. It can be viewed on IRS.gov. Because of the benefits that the Church gives the priest, many Catholic priests are exempt from taxes if they have not reached the age of 70 1/2. A priest will not receive the benefits if he is retired as of Decade X, Y, or Z (where the relevant Federal law applies). It is best to check with an attorney. (If you think your priest is still covered by this exemption, do the following: call the parish and find out. In most cases this is a mistake and no longer applies.) If you believe that your priest is entitled to this exemption or that there has been a misunderstanding, you should contact your local parish. The Church gives money back to people who take part in the sacraments, such as the Blessed Sacrament. These distributions are typically considered a donation to the Church. For example, a priest who is giving a 2,500 to a neighbor can receive a tax deduction. Clergy and Ministers The Code is silent about tax-exempt status of people who minister in private homes and other places. We don't know. However, it seems that some clergy are allowed to pay dividends from the income they earn through their services. The income tax exemption for clergy has been subject to a lot of change and abuse during the last 100 years. In recent years, the amount that clergy have been paid has dramatically increased (see chart below). As a result, clergy should make regular reports to their respective dioceses. You can find complete information on clergy on the IRS website.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 1041 (Schedule I) online Knoxville Tennessee, keep away from glitches and furnish it inside a timely method:

How to complete a Form 1041 (Schedule I) online Knoxville Tennessee?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 1041 (Schedule I) online Knoxville Tennessee aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 1041 (Schedule I) online Knoxville Tennessee from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.