Award-winning PDF software

Form 1041 (Schedule I) for Round Rock Texas: What You Should Know

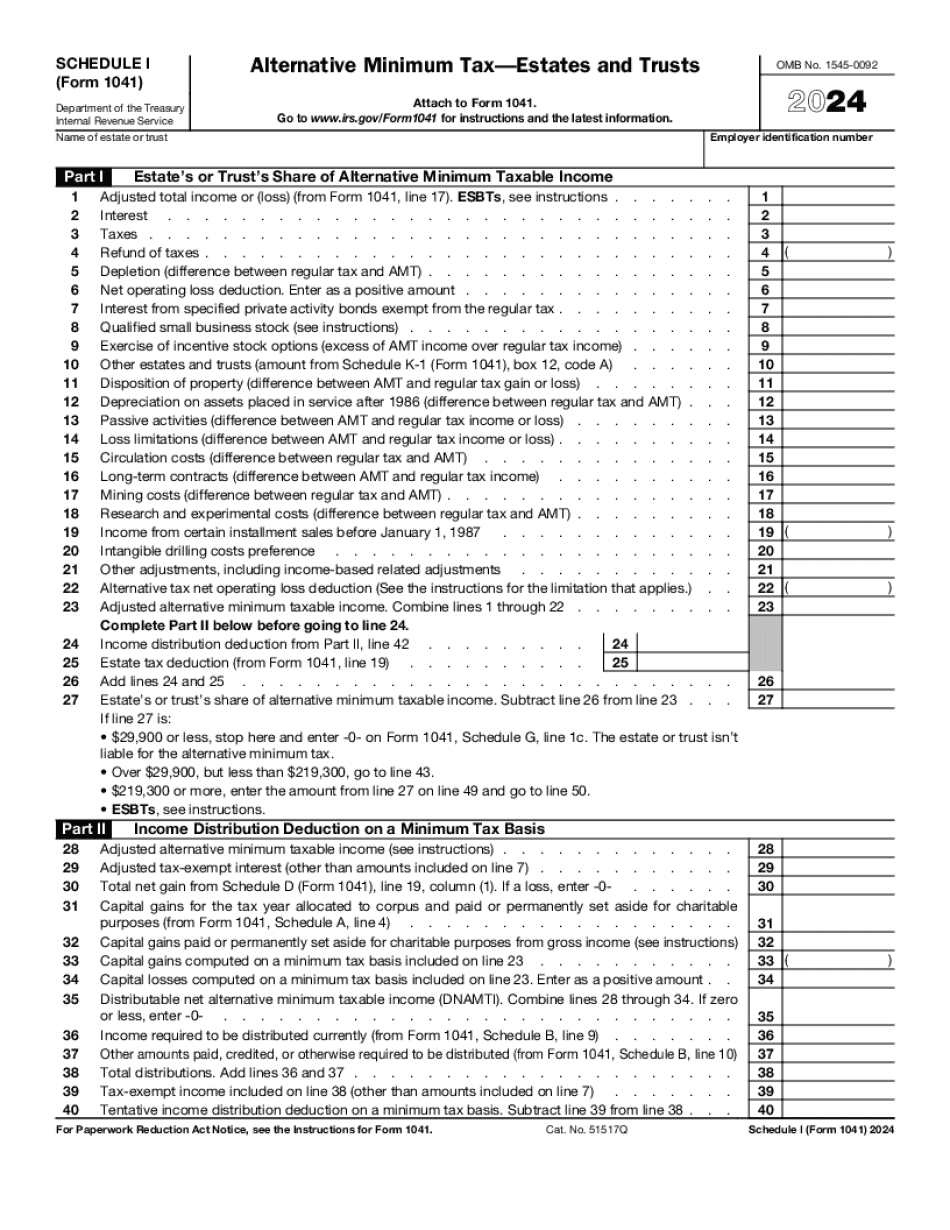

The booklet is an excellent resource for understanding the basics of a franchise tax. The Texas franchise tax is on a progressive scale and is paid on the first dollar of tax paid or accrued. This installment is for individuals. 2021 Information for Filing Your Tax Return. This booklet provides information and instructions on using the Information for Filing Your Tax Return tool on the U.S. Tax Forms and Publications page. This tax information can also be found at . Note that this document is for use by consumers and business owners, not by businesses seeking or issuing credit. This guide lists every credit and refund, and how it is received and paid. Returning Returns. If any information in these documents do not apply to your situation, the information contained in the individual or business return forms may also apply. EIN: A taxpayer identification number, issued to the individual who is filing his or her return. This number is the individual's Social Security Number, and may be written as S-1022, S-3100, or S-1310. This number is not the individual's taxpayer identification number. You may use IRS EIN instructions to obtain it. Texas Franchise Tax Code Section 3104. This law requires the State Comptroller to publish on its website at least once per year a comprehensive list of Texas business entities. The list is published on an annual basis. If you are a Texas business owner and wish to use the list in the preparation of your return, send us an application for publication together with the required fee; we will use this list for the tax return. If the business entity for which we intend to issue a return contains more than one taxpayer, we will issue a return for each. Filing a Correct & Correctable Return (Form 1040) If a taxpayer failed to include correctly information on Form 1040, he or she will be required to file a corrected return by the due date indicated on Form 1040, the first day of the following month within the time specified by statute. See Tax Bulletin 1-3, Subtitle B, Division A — Business Tax, for more information. Additional Information for Business Owners & Businesses This publication provides specific information regarding a taxpayer's or entity's obligations under the Texas Franchise Tax law. 1041-B, Schedule A—Alternative Minimum Tax; and 1041-A, Schedule G—Gross Federal Income Tax.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 1041 (Schedule I) for Round Rock Texas, keep away from glitches and furnish it inside a timely method:

How to complete a Form 1041 (Schedule I) for Round Rock Texas?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 1041 (Schedule I) for Round Rock Texas aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 1041 (Schedule I) for Round Rock Texas from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.