Award-winning PDF software

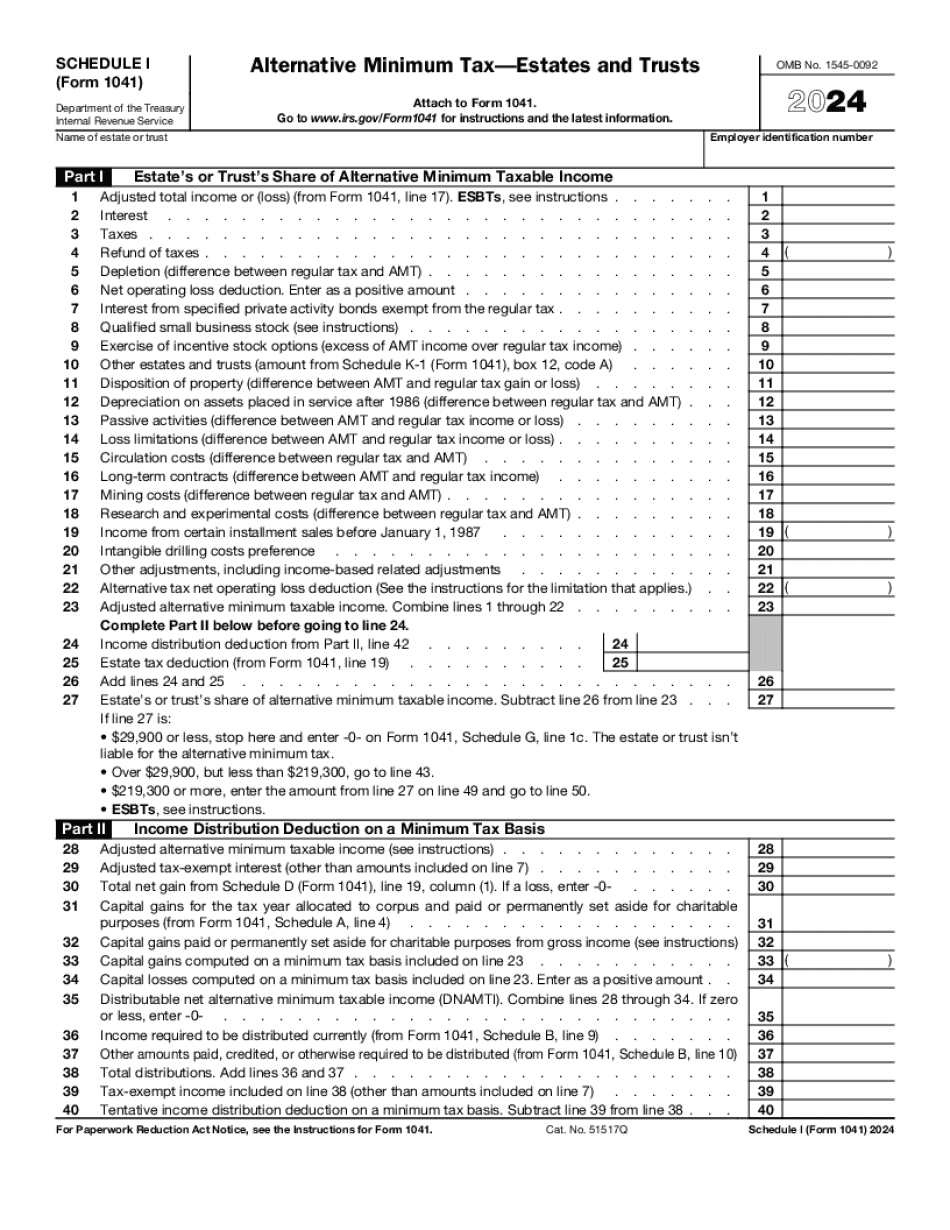

Cambridge Massachusetts online Form 1041 (Schedule I): What You Should Know

Income Tax Preparation Tools — Books & Resources The following is a list of books and resources for helping you prepare federal and state tax returns for the current tax season. Tax Preparation Software This list reflects the major software packages used by tax professionals throughout the United States (for more information, see tax and accounting software comparison). Each will provide you with a variety of services that will include (but not be limited to): tax software, tax preparation, filing, record keeping, auditing, bookkeeping and much more. As of February 2018: The Free IRS Tax Software (version 4.0): TaxA ct TurboT ax software (version 4.3.3) can be downloaded and installed for free on the Internet. If you don't want to purchase a license you do not have to get a refund, and you can enjoy the benefits of TurboT ax free of charge. The software will automatically create your tax accounts for reporting federal income taxes, federal payroll tax and state and local income taxes with the automatic filing software. TaxA ct Ready software (version 5.1.0): The US version of the popular tax software from Intuit. The software is free to use, and you can also make payments using direct check (see the “What You Get” information below). Please make sure you download and use only the tax software versions that you need, which may differ from the free versions. IRS file Software: Free with an account As of February 10, 2018, the IRS is now offering Free file for Federal Taxpayers. The IRS file service provides you an online tax return service at no cost. You can get all the most up-to-date details about your tax information, including a full listing of your federal tax deductions and credits, which you can access online. In addition, you can download your return online, and file it using the software you use. The return is then automatically sent to you within 15 days, and you get a detailed record about everything you did over the course of the year. It's the next best thing to a letter from the IRS (that was written for you).

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Cambridge Massachusetts online Form 1041 (Schedule I), keep away from glitches and furnish it inside a timely method:

How to complete a Cambridge Massachusetts online Form 1041 (Schedule I)?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Cambridge Massachusetts online Form 1041 (Schedule I) aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Cambridge Massachusetts online Form 1041 (Schedule I) from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.