Award-winning PDF software

Irs 2025 schedule 1 Form: What You Should Know

Form 1040-A. S. Individual Income Tax Return2021 13. 22Schedule, Instructions for Schedule A (Form 1040 or Form 1040-SR), Itemized Deductions, 2022, 01/05/2022. 1040 (Schedule 2), Additional Taxes, 2022, 01/05/2022. Schedule G, Itemized Deductions, 2026, 01/02/2022. Form 1040 (Schedule 1), Instructions for Schedule A (Form 1040 or Form 1040-SR), Itemized Deductions, 2026, 01/02/2022. FISCAL YEAR 2017, BUDGET PROCESSING PLAN The Fiscal Year 2025 Budget Process begins today. This is the most significant budgeting effort in 10 years. The American Taxpayer Relief Act of 2025 (AURA) is implemented, and other key provisions which affect all taxpayers are in effect starting today. These programs include the first significant reform in the federal tax code since 1991, the most significant step in tax code reform in nearly 30 years, and the first overhaul of the federal income tax system in almost 30 years. It's important to note that the tax legislation is not yet the law, nor is it necessarily enacted. Only the legislative text is available. It is still possible that provisions will be added to an amended version of the bill. You can read more about the legislative history of the legislation on Treasury's website: Taxation and the Budget. When it comes to the federal income tax, the Senate tax bill was introduced early on in 2025 and made it through Committee and the full Senate early on in the year. You might assume that this was a significant accomplishment for tax reform, but it is not. Instead, this is a significant step backward from the tax code as it currently exists. The Senate tax bill would raise taxes on thousands of people. This is not tax reform. A large portion of Americans are struggling to pay their taxes while others simply fail to understand the new complex tax system that we are now living with. This is an unfortunate reality of our federal tax system. The only way to change this is to allow the American people, their representatives, and the representatives of our state legislatures the ability to have an open, honest debate.

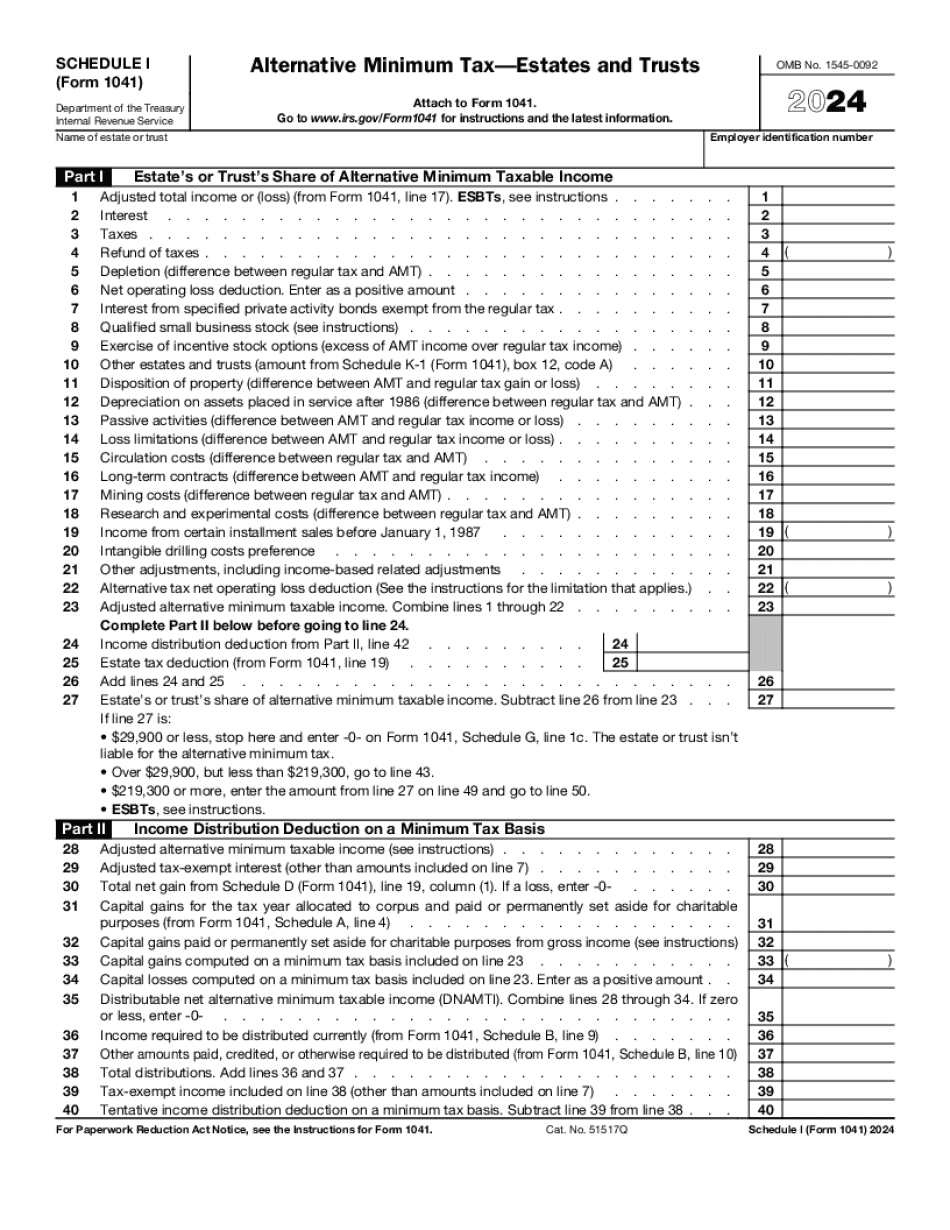

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 1041 (Schedule I), steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 1041 (Schedule I) online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 1041 (Schedule I) by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 1041 (Schedule I) from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.