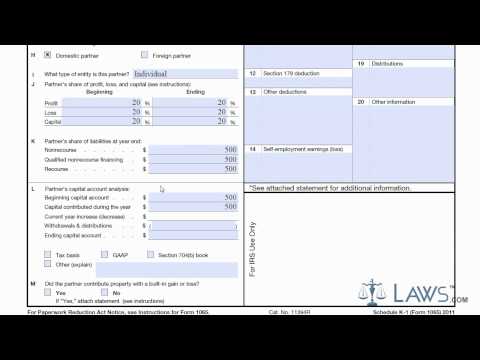

Laws calm legal forms guide Form K-1 is a United States Internal Revenue Service tax form used to report income obtained through a business partnership. - Each partner in a business should use this form to report their income or losses over a taxable year. - This form is typically used by less involved investors and partnerships, rather than partners who must report income on Form 1065. - You can obtain Form K-1 through the IRS's website or by visiting a local tax office. - To begin filling out the form, complete Section 1 by providing the partnership name, contact information, the IRS office where the partnership return was filed, and indicate whether the partnership is publicly traded. - In Part 2, provide your personal information as an investment partner, including your identifying number, name, address, and contact information. - Indicate your partnership status and whether you are an individual partner or a corporate entity on lines J and K. - Enter your total profit, loss, and capital for both the beginning and ending terms on lines J and K. - a capital account analysis on line L and provide the capitalization information over the course of the tax year. - In Part 3, list your share of income as a named partner and state any deductions, credits, or modifications in this section. - On line 1, report the ordinary income or loss incurred as a partner. - Go through each line and indicate all forms of income and losses incurred in your role as a partner. If a line is not applicable to you, you can leave it blank. - If you are claiming any deductions, enter them on the appropriate lines (lines 12 and 13). - Once you have disclosed all taxable information, your Form K-1 is completed. - Attach the form to your personal or corporate income tax return and claim...

Award-winning PDF software

Video instructions and help with filling out and completing Where 1041 Schedule Instructions