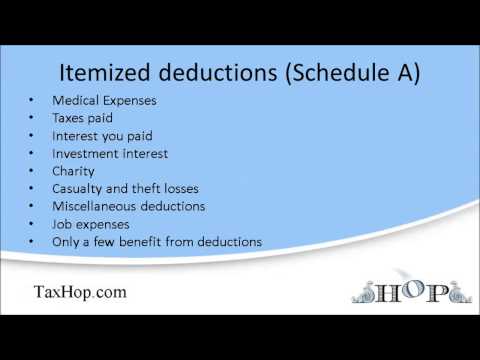

Since most people won't itemize, they can tune out this next section. But if you're one of the 25% of people who do itemize, here's the skinny on what you can or can't deduct on Schedule A. The first deductible item is for medical expenses. When I first started to do my taxes as a youngster, I thought I'd be smart and save my receipts for all my routine medical and dental checkups. I figured I'd clean up by deducting these bills. Boy, was I wrong. The truth is, unless you've got one foot in the grave and don't have insurance, you probably won't be able to take advantage of this deduction. The reason for this is that the medical deduction only helps if your unreimbursed medical expenses total more than 7.5 percent of your AGI. Still, if you have a low AGI and high medical bills, you might want to look into this deduction. Note that medical insurance payments and payments to an HMO are potentially big payments that qualify for this deduction. Also, long-term care insurance premiums became deductible medical expenses starting in 1997. Next comes state and local taxes. You also can deduct foreign taxes on Schedule A, but you're better off getting a credit, which I'll explain later. When it comes to state and local taxes, there are no real strings attached. Just total up the state and local income tax as you paid and the property taxes you paid. There's no AGI threshold to worry about. There are a few caveats, however. The first is that sales taxes are no longer deductible. Another is that assessments by a local government for services like garbage removal aren't deductible either. Finally, if you itemize and deduct state income taxes this year and then receive a state income...

Award-winning PDF software

Video instructions and help with filling out and completing Fill 1041 Schedule In Form