Divide this text into sentences and correct mistakes: 1. Laws.com legal forms guide US income tax return for estates and trusts 1041. 2. Step 1: The IRS provides detailed instructions for this form in the following instructional guide. 3. Details about the specific sections of the form are located on pages 17 through 37. 4. The 1041 form is used by the fiduciary of a domestic descendant's estate, trust, or bankruptcy estate. 5. It is used to report the following: income, deductions, gains, losses, and more for the estate or trust. 6. The income can be either accumulated or held for distribution in the future or currently being distributed. 7. It also includes reporting any income tax liability of the estate or trust and employment taxes on wages paid to household employees. 8. Step 2: The current form has an amended section E of form 1041. 9. This section is now only used for the charitable trust described in section 49 47(a)(1). 10. Step 3: For tax years beginning in 2011, the requirement to file a return for a bankruptcy estate only applies if the gross income is at least $9,500. 11. Step 4: As of June 24, 2011, a person filing a chapter 7 or chapter 11 bankruptcy estate return is now eligible for a six-month extension instead of a five-month extension. 12. Step 5: In 2011, a qualified disability trust can claim an exemption up to $3,700, and the exemption is no longer phased out. 13. Step 6: Consider the following reminders when completing this form. 14. Review a copy of the will or trust, as well as amendments and codicils. 15. The election to deduct state and local sales taxes has been extended through the tax year of 2011. 16. You are encouraged to use form 1040 1 - V to accompany your balance of tax due on this form, especially if...

Award-winning PDF software

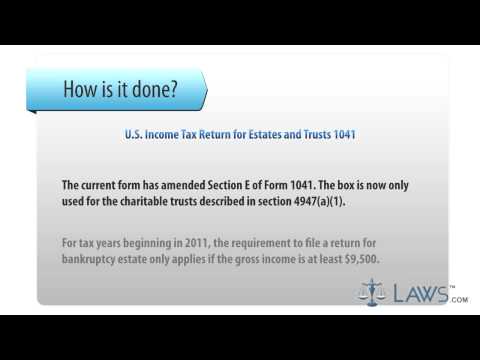

Video instructions and help with filling out and completing 1041 Schedule I Instructions