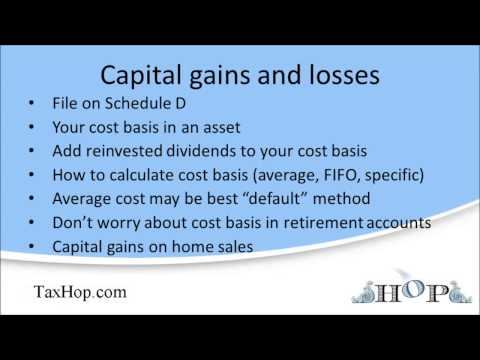

After reporting small business or self-employment income on Schedule C, report any capital gains or losses on Schedule D. A lot of people won't have any capital gains transactions, but if you sell securities or other capital assets held outside of a retirement account, you'll have to fill out Schedule D. Don't worry, the IRS has devised a system to help remind you of the need to report capital gains transactions. If you sell any securities, your broker or mutual fund should send you a 1099-B, which lists the proceeds of the sale. Since the 1099-B lists the proceeds of the sale, you'll have to include at least the gross proceeds on Schedule D. However, the 1099-B currently doesn't show the actual gain or loss you realized. For that, you're largely on your own when it comes to capital gains calculations. Your so-called basis in the property is important. In its simplest sense, your basis is the cost of the property. But your basis can be adjusted up or down depending on circumstances. Let's say you invested $1,000 in a mutual fund whose shares were selling for $10. Your $1,000 investment gives you 100 shares. Further, assume that you made this investment in early January. The fund moved up over the year, and on December 15th of the same year, the fund distributed to you $60 in dividends. You reinvested these dividends in five shares of the fund when the fund was $12 a share. A few days later, on December 20th, you sold all your holdings in the fund because you thought the market would go down. Assume your selling price was $12 a share. So, your sale of 105 shares at $12 a share yielded $1,260. Your mutual fund then sends you a 1099-B, which shows $1,260 in gross proceeds. So,...

Award-winning PDF software

Video instructions and help with filling out and completing 1041 Schedule D Instructions 2025