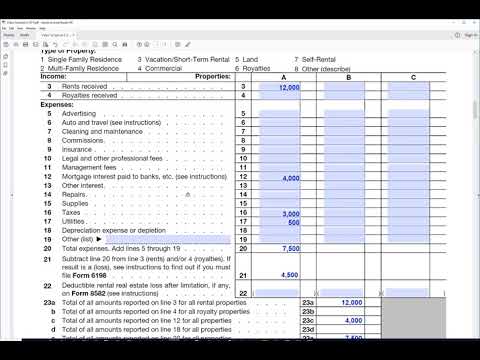

Hi, this is John with PDF Tex. This is Schedule II, which is the form that you would use if, for example, you had a rental house. That's what we're going to look at today to see how that form works if you had a rental house. So, we're going to say that we have a taxpayer here, Sam Smith, and we'll enter his social. We're going to say that Sam purchased a rental house in June of 2017, and he collected $2,000 per month from June to December. So, he collected a total of twelve thousand dollars rent on his rental house. We'll put that right there, but we need to answer these questions here. Did he have payments which would require 1099? We'll say, well, he didn't. But we also need to add an address here, so we'll just make up an address like that. Whoops, I guess we need a city, huh? There we go. Now we need to enter this information, the type of property from the list below. The list is right here, and this is a single-family residence, so we'll enter a one right here for the type of property. Then they want to know how many days was that rented. So, if it was rented from June to December, that would be 180 days, and there were no personal use days. And this doesn't apply, so we'll leave that alone. Now we need to enter some expenses for this, which goes on these lines down here. So, he probably had insurance that he paid. Well, you know, I've had insurance, but mortgage interests that he paid when he bought the house. So, let's suppose that he had four thousand dollars of mortgage interest, and then property tax. I'm sure he would have paid...

Award-winning PDF software

Video instructions and help with filling out and completing 1041 Instructions Schedule E