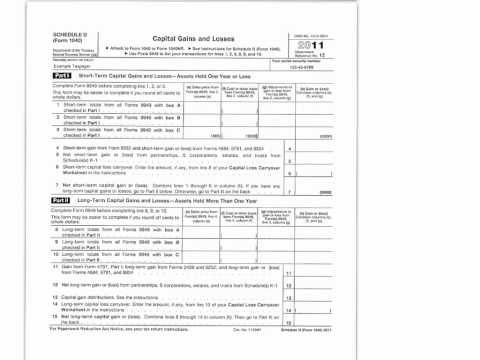

I've created this video to help explain the completion of a Form 8949 and a Schedule D. First of all, the Form 8949 rolls up onto the Schedule D, so that means we're going to have to complete the 8949 before we can complete the Schedule D. The first slide shows you the example facts. You have some stock here that you are selling for $1000, and it has a cost basis of $10,000. Using the formula you learned in Chapter one, "amount realized minus adjusted basis equals your gain or loss," that will tell you that this particular transaction has a $9,000 loss. Let's also assume that this is a short-term capital loss, so that means we acquired the stock sometime within a year and we've sold it now. The problem facts didn't give me the date acquired or the date sold, so I can make those dates up. So in column a, you're going to describe what is happening here. It was that we sold some green company stock. I've already told you that I'm making up my dates, you just need to make them up sometime in the year 2011. Column E is our sales price. We sold it for $1,000, and column F is our cost. We have a cost of $10,000. There is nothing more to complete on this form other than the totals, so jump down to the bottom and row 2 just asks you to add up all of the lines above it. So the total in column E is going to be a thousand and the total in column F is going to be 10,000. So now we can move over to our Schedule D. You may have noticed on the previous form, if not, you can pause this and play it...

Award-winning PDF software

Video instructions and help with filling out and completing 1041 Instructions Schedule D